A Biased View of Pvm Accounting

Table of ContentsThe Best Guide To Pvm AccountingThe Pvm Accounting PDFsThe 45-Second Trick For Pvm AccountingThe Definitive Guide for Pvm AccountingThe Single Strategy To Use For Pvm AccountingPvm Accounting - Truths

Oversee and take care of the development and approval of all project-related payments to customers to promote good communication and stay clear of concerns. construction taxes. Ensure that proper records and documentation are submitted to and are upgraded with the IRS. Guarantee that the audit process follows the regulation. Apply required building audit standards and procedures to the recording and coverage of building and construction task.Connect with numerous financing firms (i.e. Title Firm, Escrow Business) relating to the pay application procedure and demands required for repayment. Help with carrying out and preserving interior monetary controls and procedures.

The above statements are intended to define the basic nature and degree of job being done by people assigned to this classification. They are not to be construed as an extensive checklist of duties, tasks, and abilities needed. Personnel might be called for to do tasks outside of their normal responsibilities every so often, as needed.

The smart Trick of Pvm Accounting That Nobody is Discussing

You will certainly aid sustain the Accel team to ensure distribution of successful promptly, on budget plan, tasks. Accel is looking for a Building Accountant for the Chicago Workplace. The Building Accountant does a variety of audit, insurance coverage conformity, and project management. Works both separately and within details departments to keep financial records and make particular that all records are kept existing.

Principal duties include, however are not restricted to, handling all accounting functions of the business in a prompt and exact fashion and providing reports and routines to the business's certified public accountant Company in the preparation of all financial statements. Guarantees that all accountancy treatments and functions are taken care of properly. In charge of all financial records, payroll, banking and daily operation of the bookkeeping function.

Functions with Job Managers to prepare and upload all regular monthly invoices. Creates regular monthly Job Price to Date reports and working with PMs to reconcile with Task Managers' spending plans for each job.

The Only Guide to Pvm Accounting

Proficiency in Sage 300 Building And Construction and Property (previously Sage Timberline Workplace) and Procore building monitoring software an and also. https://www.metal-archives.com/users/pvmaccount1ng. Should additionally be efficient in other computer software program systems for the preparation of records, spread sheets and various other accounting analysis that might be required by monitoring. Clean-up accounting. Must possess solid business skills and capability to focus on

They are the economic custodians who make sure that building and construction projects wikipedia reference stay on budget plan, abide by tax policies, and preserve economic openness. Construction accountants are not just number crunchers; they are calculated companions in the building and construction procedure. Their primary role is to handle the monetary elements of building and construction tasks, making certain that resources are allocated efficiently and monetary dangers are lessened.

Rumored Buzz on Pvm Accounting

By keeping a tight grasp on job finances, accounting professionals help prevent overspending and monetary setbacks. Budgeting is a keystone of successful building and construction jobs, and construction accounting professionals are instrumental in this respect.

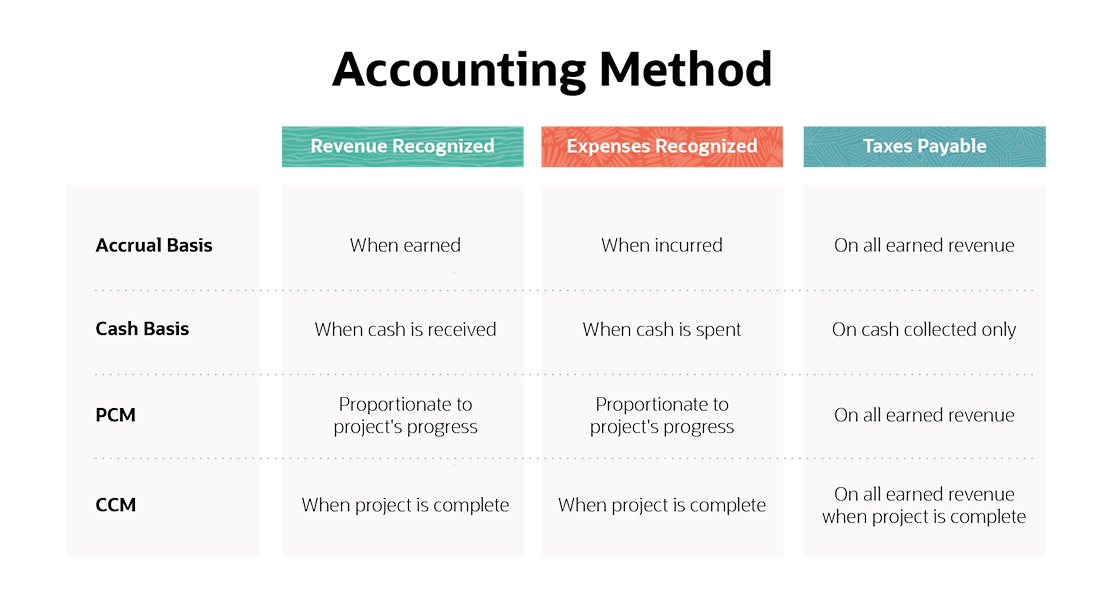

Navigating the complicated web of tax regulations in the building sector can be difficult. Building and construction accountants are fluent in these policies and make certain that the project conforms with all tax obligation demands. This consists of managing payroll tax obligations, sales taxes, and any type of various other tax obligation responsibilities details to construction. To stand out in the duty of a construction accounting professional, people need a solid academic structure in accounting and financing.

Furthermore, qualifications such as Certified Public Accountant (CPA) or Licensed Building Market Financial Expert (CCIFP) are extremely pertained to in the sector. Functioning as an accounting professional in the building and construction sector features an one-of-a-kind collection of obstacles. Building and construction tasks often involve limited target dates, transforming laws, and unanticipated expenditures. Accounting professionals need to adapt rapidly to these difficulties to keep the project's economic wellness undamaged.

The Greatest Guide To Pvm Accounting

Ans: Construction accounting professionals produce and monitor spending plans, determining cost-saving opportunities and ensuring that the task stays within budget. Ans: Yes, building and construction accounting professionals handle tax conformity for building and construction jobs.

Intro to Building And Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make difficult selections among several monetary alternatives, like bidding process on one job over another, choosing funding for products or devices, or setting a task's earnings margin. On top of that, building and construction is a notoriously unstable sector with a high failure price, sluggish time to settlement, and inconsistent money circulation.

Normal manufacturerConstruction company Process-based. Production entails repeated procedures with quickly identifiable prices. Project-based. Production calls for different procedures, products, and equipment with differing costs. Dealt with place. Manufacturing or production happens in a single (or several) controlled locations. Decentralized. Each job occurs in a brand-new location with differing website conditions and one-of-a-kind difficulties.

Pvm Accounting Things To Know Before You Get This

Long-lasting relationships with vendors alleviate settlements and boost performance. Irregular. Frequent use various specialty professionals and vendors influences performance and capital. No retainage. Payment arrives completely or with regular repayments for the full contract amount. Retainage. Some portion of payment may be withheld until project completion also when the contractor's work is finished.

Routine production and temporary agreements cause workable capital cycles. Uneven. Retainage, sluggish repayments, and high upfront prices cause long, irregular capital cycles - Clean-up accounting. While typical suppliers have the advantage of controlled environments and optimized manufacturing procedures, building companies have to frequently adjust to every brand-new job. Even rather repeatable jobs call for alterations because of website conditions and other aspects.